Property Management

Property Management Accounting

Welcome to MaRSFi, where we offer tailored property management and accounting solutions for real estate investors, landlords, and property managers in Massachusetts, Arizona, Texas, and New York. Our outsourced property accounting services are designed to simplify financial complexities, enabling you to overcome challenges and seize opportunities.

Property management involves more than just finding tenants, collecting rent, and maintaining properties—it requires precise financial management. Property management accounting plays a crucial role in achieving financial success. It helps keep your property portfolio’s finances in check.

At MaRSFi, we specialize in property management accounting. Our customized bookkeeping services simplify financial operations, covering tasks like month-end and year-end adjustments, depreciation, accruals, prepayments, and deferred revenue.

MaRSFi provides real estate accounting solutions for landlords, investors, and property managers across Massachusetts, Arizona, Texas, and New York. Our team of expert property accountants streamlines your financial processes, ensuring accurate record-keeping, financial transparency, and regulatory compliance. Whether managing residential, commercial, or mixed-use properties, our accounting services will help you identify opportunities for growth.

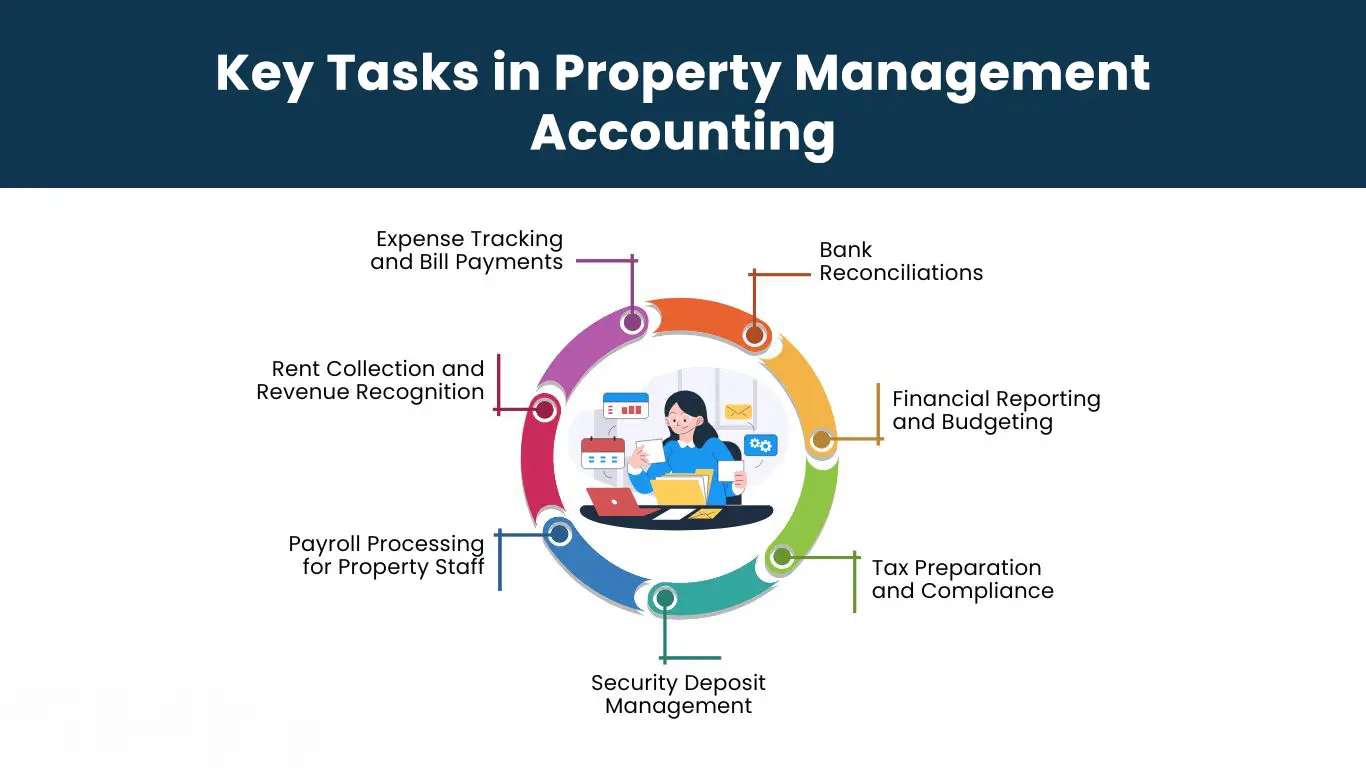

Key Tasks in Property Management Accounting

Effective Property Management Accounting involves precise processes to keep financial records up to date. Some of the key bookkeeping tasks include:

Rent Collection and Revenue Recognition

- Recording rental payments from tenants

- Monitoring overdue payments and applicable late charges

- Creating invoices and rent statements

Expense Tracking and Bill Payments

- Logging utility bills, maintenance expenses, and repair costs

- Managing contractor payments

- Categorizing expenses for tax reporting

Bank Reconciliations

- Verifying that all transactions align with bank statements

Detecting and correcting discrepancies

Tax Preparation and Compliance

- Generating tax documents for property owners

Monitoring deductible expenses

Ensuring adherence to property tax laws

Financial Reporting and Budgeting

- Income and expense statements

Cash flow assessment - Budget planning for property upkeep and upgrades

Security Deposit Management

- Logging security deposits

- Handling refunds and deductions

Payroll Processing for Property Staff

- Processing payments for property managers, maintenance staff, and employees

- Handling payroll taxes and employee benefits

Challenges in Property Management Accounting

Property managers often encounter several accounting hurdles due to the volume and complexity of transactions. Common challenges include:

Market Fluctuations – Economic shifts can influence property values and rental revenue, impacting overall financial performance.

Tenant Coordination – As tenant numbers grow, maintaining smooth relationships and accurate records becomes increasingly demanding.

Diversified Investments – Expanding into new markets to balance risk adds layers of financial tracking and strategy.

Complex Dealings – Handling transactions across multiple properties and tenants can create accounting intricacies.

Delayed Rent and Revenue Issues – Late payments cause cash flow disruptions and delay accurate revenue recognition.

Tax and Legal Compliance – Staying up to date with property tax rules and regulations is time-consuming and detail-heavy.

Disorganized Expense Records – Poor tracking results in incorrect reports and missed deductions.

Managing Multiple Property Ledgers – Monitoring finances across several units or locations requires robust accounting systems.

How MaRSFi Services Overcome Property Management Accounting Challenges

We at MaRSFi leverage advanced property management accounting tools and our deep expertise to tackle the industry’s most pressing challenges:

Automated Financial Management: Our streamlined bookkeeping minimizes manual effort and ensures high accuracy.

Seamless Rent Collection: We integrate leading property management accounting platforms for efficient rent tracking.

Full Compliance Assurance: Our team monitors tax updates and reporting standards to maintain complete regulatory compliance.

Scalable Multi-Property Solutions: From a single property to an expansive portfolio, our services scale with your business needs.

Real-Time Financial Visibility: Our insights empower property managers to make confident, data-backed decisions.

Our Accounting & Bookkeeping Services for Franchise Businesses

We offer a complete range of accounting services to support franchise growth and financial stability.

Financial Reporting & Analysis

- Preparation of monthly income and expense statements

- Managing and projecting cash flow

- Strategies to maximize revenue and control costs

- Reviewing and maintaining the general ledger

- Generating financial reports on a monthly, quarterly, and annual basis

- Consolidating financials for multiple real estate assets

- Analyzing budget variances and tracking expenditures

- Evaluating occupancy rates and income performance

- Delivering KPI reports with actionable insights

Bookkeeping Services

- Daily financial entry and classification

- Monitoring expenses and reconciling accounts

- Customized chart of accounts for each property

- Rent tracking and detailed tenant ledger maintenance

- Handling and reconciling security deposits

- Managing vendor payments and accounts payable

- Reconciling bank and credit card statements

- Tracking mortgage and loan repayments

- Performing CAM (Common Area Maintenance) reconciliations

- Monitoring property tax and insurance outflows

- Conducting month-end and year-end closings, including prepayments, depreciation, accruals, and deferred income adjustments

Payroll Processing

Administering payroll for property managers, maintenance teams, and contractors

Managing tax withholdings, employee benefits, and compliance reporting

Processing direct deposits efficiently

Tax Compliance & Sales Tax Filing

- Monitoring property tax assessments and payments

- Preparing and filing real estate tax returns

- Calculating and reporting sales tax where applicable

- Ensuring compliance with payroll tax regulations for staff

Fixed Assets & Cash Flow Management

- Monitoring fixed assets and managing depreciation schedules

- Projecting cash flow and planning reserve funds

- Establishing accounting systems for newly acquired properties

Property Management Software & Accounting Integration

- Seamless integration with top property management software like Buildium, AppFolio, RealPage, Rent Manager, Yardi, and others

- Support for leading accounting tools including QuickBooks, Xero, Sage Intacct, and more

- Automated data syncing to ensure real-time and accurate financial reporting

With MaRSFi, real estate investors and property managers can expand their investment portfolios and build strong client relationships. We ensure complete transparency in our financial management, offering accurate and reliable services. Our detailed financial reports empower you to make informed decisions for long-term success and stability.

Accounting Solutions for Every Property Management Model

At MaRSFi, we offer tailored real estate accounting solutions that streamline financial management, ensure regulatory compliance, and optimize profitability. Whether you’re managing a single rental property or a large real estate portfolio, our services are scalable to meet your specific requirements.

Small Property Owners & Independent Landlords

- Simplified property management accounting to monitor rental income and expenses

- Affordable bookkeeping solutions for effective cash flow management

- Automated rent collection and lease tracking

- Integration with basic real estate accounting software

Mid-Sized Property Management Firms

- Advanced property management accounting support for financial reporting

- Automated accounts payable and vendor management

- Budgeting and forecasting to support portfolio growth

- Compliance with tax regulations and reporting standards

Large-Scale Property Management & Real Estate Firms

- Real estate accounting software integration for multi-property reporting

- Lease and tenant financial management for enhanced efficiency

- Comprehensive financial statements and profitability analysis

- Custom tax planning and regulatory compliance solutions

HOAs & Commercial Property Management

- Consolidated financial reporting across multiple properties

- Reserve fund management and expense tracking

- Advanced tax planning for HOA and commercial property regulations

- Automated payroll and contractor payments

Whatever the size of your portfolio, MaRSFi ensures accurate financial management, streamlined reporting, and long-term financial success.

Get started with MaRSFi Today

Dealing with rental income and property deals can never be complete without financial management. At MaRSFi, we have been providing property management accounting services for years. We house specialized accountants for property managers, real estate investors, and landlords.

Our property management accounting services can help you maximize rental income and ensure long-term property value. We provide solutions for property managers, real estate investors, and landlords. Whether you own a single rental property or manage a large portfolio, our services can simplify your financial operations. Contact us now and get to know how you can drive your property management business toward success.